By Joe Montero

Deloitte Economics has just warned that Australia’s government budget deficit will balloon to $33 billion by next year’s budget in May. In part, this is to pressure the government into cutting back spending. After all, Deloitte Economics, the British accounting giant, is very much of the corporate world. But one should not ignore that there may be something in what they are saying.

Their new report on Australia predicts the biggest contraction in the financial system yet, excluding the covid pandemic period. This is important. Where Deloitte goes wrong is that it concentrates on being critical of the provision of stimulus by recent governments. Many would argue that without this, tough economic times would have been even worse and the damage to the economy much more serious. Spruiking for government spending cuts is not what is needed.

The report is right, however, in pointing out the weakness of relying on income from mineral and fossil fuel resources exports. This is declining in today’s conditions, and it would be wise for Australia to end this dependency.

They are also right about the prospect of trade war, which will hamper Australia’s trading position, in terms of trade with both China and the United States. So long as Australia joins in the economic war against China, exports to that country are bound to be restricted. Increasing protectionisms in the United States will make it more difficult to export there. Expect higher prices for everyday necessities. In other words, problematic inflation will still be with us.

Incoming President Donld Trump has vowed to Impose widespread tariffs on imports. Australia won’t be immune from the direct impact of this, and the effects of the inevitable escalation of trade war against China.

Most important will be increasing volatility and unpredictability in the global financial market. This will have a serious negative impact on investment. In part, this arises out of what is going on in the United States. It’s debt to the outside words is a crippling $US35 trillion government debt, and a private debt approaching $US100 trillion, according to publicly available figures. This signals a faltering economy and growing instability of the United States’ dollar.

The global economy is shrinking. Were it not for China, Russia, India. Iran and some of the other BRICs related economies, the global economy would be shrinking and in a dire state indeed. This is worth thinking about.

Since the Australian economy is so intimately bound into the American one, and the bulk of investment comes from there, the impact must flow to us in the forms of disruption to the financial market, effect on the Australian dollar, the increased cost of imports, and economic growth slowing further than would otherwise be the case.

it’s likely that the theory behind Deloitte’s reasoning is that the Australian government should concentrate on further loosening regulation of the financial system to free up investment. This, the argument goes, will ensure the growth of investment to drive the economy int success. It suits many of Deloitte’s major clients and therefore its own bottom line.

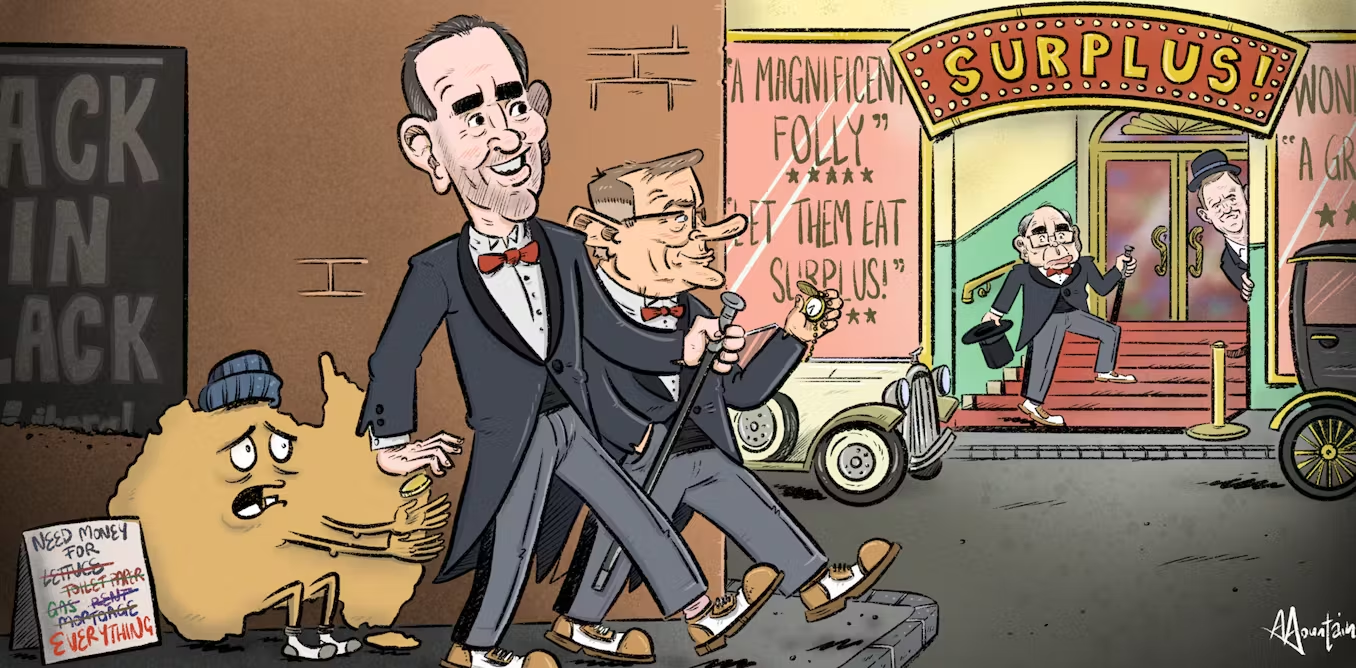

The sidekick is turning government expenditure away from the provision of services and towards assisting big investors. Saying this openly wouldn’t be popular. Better to couch this in talking about “a coddled and cosseted economy bereft of competitiveness and dynamism.’’ As the cause of poor economic performance.

According to this line of reasoning the state of the economy has little to do with what is going on in the United States, the global economy, and structural problems within the Australian economy.

Domestic structural problems in the economy are the other big part of the equation behind Australia’s economic condition. We live in an extremely monopolised economy with an excessive dependency on foreign investment limiting the capacity for economic management. The economy is over weighted towards a financial economy, which already highly unregulated and operating out of harmony with the rest of the economy. This has shifted away from building the capacity to make things.

Excessive and unhealthy reliance on household debt, futures markets, share prices, the real estate bubble, and mineral and fossil fuel exports as the driver of the economy is the result. A better future depends on breaking away from this.